Finance crime probes rely heavily on prosecutorial discretion, a powerful tool shaping case outcomes. Prosecutors strategically weigh evidence and consider public interest to decide whether to pursue charges, influencing national trends in financial crime deterrence and cooperation. Effective balancing of this power leads to significant achievements in combating financial crimes, ensuring economic integrity. However, its impact can vary widely, especially in complex white-collar offenses, underscoring the need for fairness, transparency, and accountability through open data, oversight bodies, and ethical conduct training. Understanding and managing prosecutorial discretion are crucial to mitigate its impact on case outcomes.

“Unraveling the intricacies of finance crime probes, this article offers a comprehensive guide to understanding the pivotal role of prosecutorial discretion. We explore how this discretionary power shapes case outcomes in various financial crimes, with a specific focus on its impact.

From manipulating stock prices to money laundering, we analyze different scenarios, revealing the complexities involved. Furthermore, it delves into strategies aimed at enhancing transparency and accountability in prosecution decisions, especially concerning prosecutorial discretion’s influence on sentencing and resolutions.”

- Understanding Finance Crime Probes: A Comprehensive Overview

- The Role of Prosecutorial Discretion in Case Outcomes

- Analyzing the Impact of Discretion on Different Types of Financial Crimes

- Strategies to Enhance Transparency and Accountability in Prosecution Decisions

Understanding Finance Crime Probes: A Comprehensive Overview

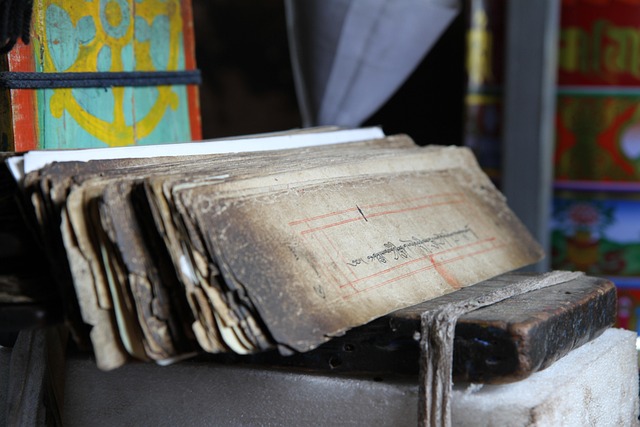

Finance crime probes are a critical aspect of maintaining economic integrity and justice. These investigations delve into illicit financial activities, from money laundering to fraud, ensuring accountability and deterring future criminal behavior. At the heart of these proceedings lies prosecutorial discretion, a powerful tool that significantly impacts case outcomes. Prosecutors must carefully weigh evidence, assess the public interest, and consider potential sentencing when deciding whether or not to pursue charges. This strategic decision-making process plays a pivotal role in shaping the trajectory of financial crime cases.

The impact of prosecutorial discretion extends beyond individual cases; it influences trends across the country. By prioritizing certain types of financial crimes over others, prosecutors can send powerful messages, encouraging cooperation and deterring those who might be tempted to engage in similar illicit activities. This approach, when balanced effectively, can lead to achieving extraordinary results in the fight against financial crime, ultimately fostering a more secure economic environment for all.

The Role of Prosecutorial Discretion in Case Outcomes

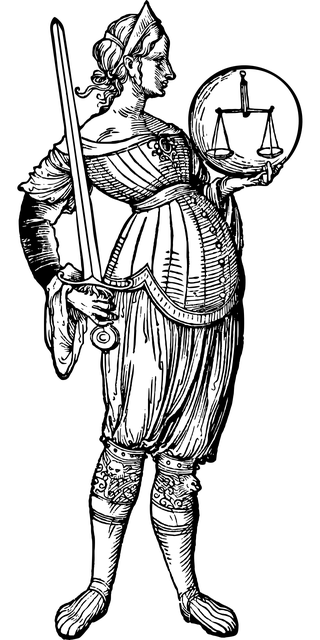

The role of prosecutorial discretion is a critical yet often overlooked aspect when considering the impact on case outcomes. Prosecutors hold significant power in determining how to pursue charges, which can significantly sway the direction and outcome of legal cases, especially in high-stakes scenarios. Their decisions go beyond mere filing of charges; they shape the narrative that guides investigations and influence the strategies employed by both parties.

This discretion is particularly evident in winning challenging defense verdicts or avoiding indictment. Skilled prosecutors know how to navigate complex legal landscapes, leveraging their expertise to build robust cases or strategically withdraw them when prospects seem bleak. This discretionary power underscores the importance of fair and impartial prosecution, ensuring that justice isn’t merely served but also perceived as such by all involved parties.

Analyzing the Impact of Discretion on Different Types of Financial Crimes

In the realm of finance crime probes, prosecutorial discretion plays a pivotal role in shaping case outcomes. This power allows prosecutors to select which cases to pursue and how aggressively, significantly influencing the path of justice. The impact of this discretion is multifaceted, with profound effects on various types of financial crimes. For instance, in high-stakes cases involving complex white-collar offenses, discretionary decisions can determine whether a defendant faces charges or walks free, potentially leading to winning challenging defense verdicts.

Analyzing the prosecutorial discretion impact on case outcomes reveals a delicate balance. On one hand, it enables prosecutors to prioritize resources effectively, focusing on achieving extraordinary results in cases that warrant significant attention. On the other, discretionary practices must be fair and transparent to prevent perceptions of bias or favoritism, which could undermine public trust. In navigating this labyrinthine process, understanding the discretion’s effect becomes crucial for both legal professionals and those involved in high-pressure financial crime investigations, ensuring justice is served equitably in these intricate matters.

Strategies to Enhance Transparency and Accountability in Prosecution Decisions

To enhance transparency and accountability in prosecution decisions, several strategies can be implemented. One key approach is to promote open-source data and clear reporting mechanisms. By making information about case outcomes, charging decisions, and sentencing guidelines readily available to the public, stakeholders including the media, general criminal defense lawyers, and philanthropic and political communities can scrutinize and hold prosecutors accountable. This transparency helps ensure that prosecutorial discretion is exercised fairly and does not disproportionately impact certain demographics or cases.

Additionally, establishing independent oversight bodies can significantly contribute to accountability. These bodies could review and audit prosecution practices, investigate complaints against prosecutors, and recommend policy changes when necessary. Promoting a culture of ethical conduct and professional standards among prosecutors is also crucial. Regular training programs that emphasize the importance of impartiality, fairness, and objectivity in decision-making can help avoid indictment for cases where the evidence warrants it, thereby ensuring that justice is served without political influence or personal bias.

The intricate relationship between prosecutorial discretion and the outcomes of finance crime cases is a critical aspect that shapes the criminal justice system. As this article has explored, understanding how discretion influences decisions, particularly in financial crimes, is essential. By analyzing its impact across various types of offenses, we uncover the need for enhanced transparency and accountability measures. Strategies to improve these processes are vital to ensure fairness and consistency in prosecution, ultimately addressing potential biases and ensuring justice is served in every case involving financial misconduct.